The Main Principles Of Risk Management Enterprise

Risk Management Enterprise Can Be Fun For Anyone

Table of ContentsThe Only Guide to Risk Management EnterpriseThe 4-Minute Rule for Risk Management EnterpriseThe Risk Management Enterprise DiariesThe 10-Minute Rule for Risk Management EnterpriseThe 10-Second Trick For Risk Management EnterpriseNot known Facts About Risk Management EnterpriseRisk Management Enterprise Things To Know Before You Get This

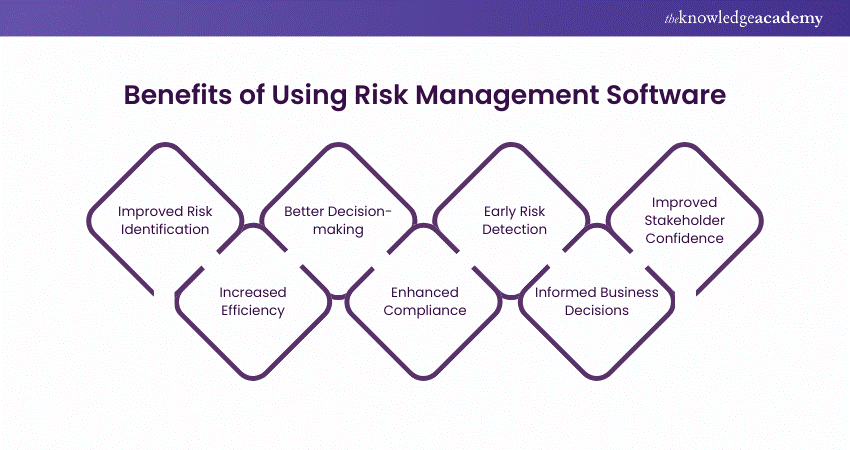

By leveraging a proactive outlook and very carefully taking into consideration various scenarios, you have the ability to have a far better grasp on prospective dangers that your organization can face. When you have an understanding and clear overview, you can determine how to continue to straighten activities with organization goals. In doing so, you establish and cultivate a society that is not terrified of threats, as well as one that operates with both dexterity and strength.With a strong danger administration strategy, you're displaying your degree of treatment and intention to stakeholders, which breeds confidence - Risk Management Enterprise. By recognizing risks, leaders and management teams can properly allocate resources to ideal take care of future end results. This includes funds, in addition to exactly how to designate duties to various individuals within your group in order to ideal carry out and handle the picked strategy

The 9-Minute Rule for Risk Management Enterprise

With automation software program, you can feel confident that you'll have all your company's data nicely systematized and ready-to-use for analysis or recommendation. While the details of every organization's danger management plan will certainly differ, there are best methods worthwhile to think about and comply with to efficiently practice risk monitoring. Remember these recommendations: Maintain the company's goals at the forefront of every choice Be organized Take advantage of info and data for decision-making Include every person in your company who is involved Display continually and make changes as required Produce worth for the company Use modern technology and automation software any place possible There may be other incidents and circumstances that approach that difficulty your risk monitoring prepares to drop apart.

A small blunder can cause significant damage, particularly in extremely regulated markets like financing. And, also if all individuals are in area and trained, errors take place that can be because of bad governance. Risk Management Enterprise. That's why it's crucial to have trustworthy software, standard techniques, and oversight in area to safeguard your business against mishaps and mistakes

Throughout, links attach to other posts that deliver more thorough details on the subjects covered here. Risk monitoring is important to service success-- probably more so now than ever. The threats that contemporary companies deal with have actually expanded a lot more intricate, sustained by the rapid pace of globalization. New threats continuously emerge, usually pertaining to the now-pervasive use technology.

Getting The Risk Management Enterprise To Work

Lots of companies are still grappling with several of the dangers presented by the COVID-19 pandemic. That includes the recurring requirement to manage remote or hybrid job settings and what can be done to make supply chains less vulnerable to disturbances. Because of this, a risk monitoring program must be intertwined with business strategy.

Below's a primer on danger exposure in an organization and just how it's determined. Numerous professionals note that taking care of danger is a formal feature at firms that are heavily regulated and have a risk-based organization design. Banks and insurer, for example, have actually long had big danger departments normally headed by a primary risk police officer (CRO), a title still fairly uncommon beyond the financial sector.

What Does Risk Management Enterprise Do?

For other markets, danger has a tendency to be more qualitative. That raises the demand for a deliberate, complete and regular approach to risk monitoring, claimed Gartner method vice head of state Matt Shinkman, who leads the consulting firm's risk management and audit techniques.

Display the outcomes of risk controls and adjust as essential. These are the vital steps to take to recognize, examine and manage risks. These steps audio simple, but threat management committees established to lead campaigns shouldn't ignore the work required to finish the process - Risk Management Enterprise. For beginners, a solid understanding of what makes the organization tick is required.

They also record risk feedback plans, threat owners and stakeholders, and the expense of handling threats. A downloadable danger register layout can be discovered in the write-up linked to above. Firms can acquire these advantages by using a danger register as part of their danger management programs. As federal government and industry compliance guidelines have increased over the past twenty years, regulative and board-level analysis of company risk administration methods have actually also enhanced.

Strategy and objective-setting. Information, communication and coverage. ISO 31000.

Some Known Details About Risk Management Enterprise

The more recent variation likewise highlights the important duty of senior management in risk programs and the assimilation of danger administration methods throughout the organization. Some national criteria bodies and groups have actually likewise launched country-specific versions of ISO 31000. For instance, the American National Standards Institute supplies a variation that's managed by the American Society of Safety And Security Professionals.

Risk averse is one more additional resources characteristic of companies with conventional threat administration programs. For lots of companies, "threat is a dirty obscenity-- which's unfavorable," Valente stated. "In ERM, threat is checked out as a strategic enabler versus the expense of doing organization." "Siloed" vs. all natural is one of the huge differences between both approaches, according to Shinkman.

Conventional danger monitoring additionally often tends to be reactive. In business danger monitoring, managing danger is a joint, cross-functional and big-picture initiative. An ERM group debriefs business unit leaders and personnel concerning threats in their areas and helps them think with the dangers. The group after that collates details regarding all the risks and presents it to elderly executives and the board.

Some Known Incorrect Statements About Risk Management Enterprise

The former operate at firms that see risk administration as an insurance policy, according to Forrester. Transformational CROs concentrate on their firm's brand name credibility, comprehend the horizontal nature of danger and sight ERM as a way to allow the "appropriate amount of threat required to expand," as Valente placed it.

Extra confidence in organizational goals and goals because risk is factored right into method. Better and extra reliable compliance with regulative and inner requireds. Improved functional effectiveness with more consistent application of risk procedures and controls. Boosted work environment safety and safety and security. A competitive benefit over organization competitors with much less mature danger monitoring programs.

ISO 31000's general seven-step process is a valuable guide to follow for developing a strategy and afterwards implementing an ERM structure, according to Witte. Here's an extra comprehensive rundown of its parts: Interaction and assessment. Raising threat understanding is a crucial part of threat monitoring. The look at this now interaction plan established wikipedia reference by threat leaders should efficiently share the organization's danger plans and treatments to employees and various other relevant events.

Risk Management Enterprise Can Be Fun For Everyone

Developing the scope and context. This action needs specifying both the company's risk cravings and risk resistance. The latter term refers to just how a lot the threats connected with certain efforts can vary from the total risk appetite. Elements to consider right here include business goals, company society, regulatory needs and the political atmosphere, to name a few.